Step-by-Step Directions for Completing Your Online Tax Return in Australia Without Errors

Step-by-Step Directions for Completing Your Online Tax Return in Australia Without Errors

Blog Article

Simplify Your Funds: Exactly How to Submit Your Online Income Tax Return in Australia

Declaring your on the internet tax return in Australia need not be a challenging job if come close to carefully. Recognizing the details of the tax obligation system and adequately preparing your documents are essential initial actions.

Understanding the Tax Obligation System

To navigate the Australian tax system effectively, it is necessary to grasp its basic concepts and structure. The Australian tax system operates a self-assessment basis, suggesting taxpayers are liable for precisely reporting their income and calculating their tax obligation responsibilities. The primary tax authority, the Australian Taxes Workplace (ATO), manages compliance and enforces tax obligation legislations.

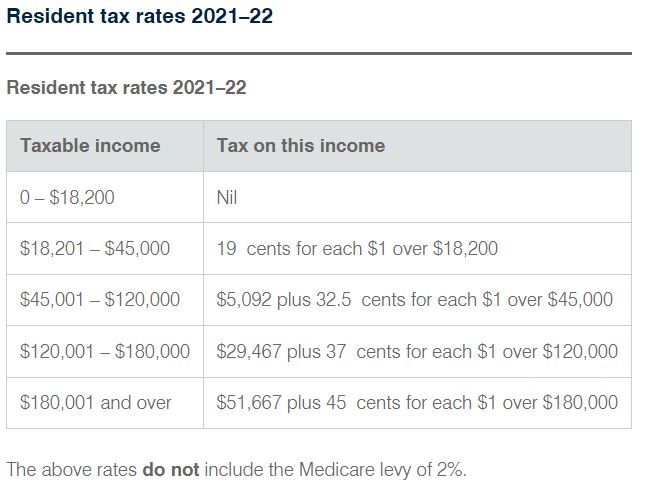

The tax system consists of different elements, including revenue tax, services and items tax (GST), and capital gains tax obligation (CGT), among others. Specific earnings tax is dynamic, with rates increasing as earnings rises, while company tax prices differ for tiny and large organizations. In addition, tax offsets and deductions are offered to reduce gross income, enabling for more tailored tax responsibilities based on individual situations.

Knowledge tax residency is likewise crucial, as it establishes an individual's tax obligation obligations. Citizens are taxed on their around the world revenue, while non-residents are only tired on Australian-sourced revenue. Familiarity with these concepts will certainly empower taxpayers to make educated choices, ensuring compliance and possibly maximizing their tax results as they prepare to submit their online tax returns.

Preparing Your Records

Gathering the required papers is a crucial action in preparing to file your on the internet tax obligation return in Australia. Correct documentation not only enhances the declaring procedure yet also guarantees accuracy, lessening the danger of mistakes that can lead to penalties or delays.

Start by accumulating your revenue declarations, such as your PAYG payment summaries from employers, which detail your incomes and tax obligation held back. online tax return in Australia. Guarantee you have your organization revenue records and any type of appropriate invoices if you are self-employed. In addition, collect bank statements and documents for any kind of interest made

Following, compile documents of deductible costs. This may include receipts for work-related expenditures, such as attires, travel, and devices, along with any type of academic expenses connected to your career. Ensure you have paperwork for rental income and linked costs like repair work or residential or commercial property management charges. if you own property.

Don't forget to consist of other pertinent files, such as your wellness insurance coverage details, superannuation payments, and any financial investment income statements. By meticulously organizing these documents, you set a strong foundation for a smooth and reliable on-line tax return process.

Picking an Online Platform

After arranging your paperwork, the following step entails selecting an ideal online platform for submitting your tax return. online tax return in Australia. In Australia, a number of trusted systems are offered, each offering unique functions customized to different taxpayer requirements

When choosing an on the internet platform, consider the interface and ease of navigating. A simple layout can substantially boost your experience, making it less complicated to input your info accurately. Additionally, make certain the system is certified with the Australian Tax Office (ATO) policies, as this this website will certainly assure that your entry meets all legal needs.

Another vital variable is the availability of customer support. Platforms using real-time talk, phone support, or extensive FAQs can supply beneficial aid if you encounter challenges throughout the declaring procedure. Analyze the protection actions in area to shield click here to read your individual details. Seek systems that make use of security and have a strong personal privacy policy.

Lastly, consider the prices related to numerous platforms. While some may offer cost-free solutions for fundamental income tax return, others might bill fees for advanced attributes or added support. Weigh these factors to pick the platform that aligns ideal with your financial situation and declaring needs.

Step-by-Step Filing Procedure

The step-by-step filing procedure for your on-line income tax return in Australia is developed to streamline the entry of your financial details while making sure compliance with ATO guidelines. Begin by collecting all essential papers, including your income declarations, bank declarations, and any receipts for reductions.

When you have your records prepared, visit to your selected online system and create or access your account. Input your individual information, including your Tax Documents Number (TFN) and contact info. Following, enter your income information accurately, guaranteeing to consist of all incomes such as wages, rental income, or financial investment earnings.

After outlining your revenue, go on to declare qualified reductions. This may include occupational expenses, charitable contributions, and clinical expenses. Make certain to examine the ATO standards to maximize your insurance claims.

As soon as all details is entered, very carefully assess your return for precision, fixing any discrepancies. After making sure every little thing is correct, submit your tax return digitally. You will certainly obtain a verification of entry; maintain this for your records. Lastly, monitor your represent any type of updates from the ATO concerning your income tax return standing.

Tips for a Smooth Experience

Finishing your online income tax return can be a simple process with the right prep work and mindset. To guarantee a smooth experience, begin by gathering all essential files, such as your revenue declarations, receipts for reductions, and any kind of various other relevant monetary documents. This organization reduces errors and saves time during the filing procedure.

Next, acquaint on your own with the Australian Taxation Workplace (ATO) web site and its online solutions. Use the ATO's sources, consisting of overviews and FAQs, to make clear any type of uncertainties prior to you start. online tax return in Australia. Consider establishing up a MyGov account linked to the ATO for a structured filing experience

In addition, capitalize on the pre-fill functionality used by the ATO, which automatically inhabits some of your details, decreasing the opportunity of errors. Guarantee you confirm all access for accuracy prior to entry.

If complications occur, do not wait to speak with a tax obligation professional or utilize the ATO's support services. Adhering to these pointers can lead to a easy and effective on-line tax obligation return experience.

Verdict

To conclude, filing an online tax return in Australia can be streamlined through careful preparation and selection of suitable resources. By understanding the tax system, organizing necessary files, and choosing a compliant online platform, people can browse the filing procedure efficiently. Complying with a structured strategy and making use of offered assistance makes sure accuracy and maximizes eligible deductions. Inevitably, these techniques add to a much more effective tax filing experience, streamlining monetary administration and enhancing compliance with tax obligation responsibilities.

Report this page